Value Investing in Growing Companies (Premier)

Our Sample Stock performed 78% in 6 months

Watch Promo

"An Investment in knowledge pays the best interest" - Benjamin Franklin

"Someone's sitting in the shade today, because someone planted a tree a long time ago" - Warren Buffett

Are you tired of your 9 - 5 job?

Are you having trouble managing your expenses and paying your tuition fees?

Are you looking for options to grow your savings?

Are you looking for strategies that can make your investments grow with time while you sit back and relax?

Well, this course is for you

Do you know

A $10 in 1914 would have grown to become $ 2967 today if you left it in stocks and forgot about it. This a massive gain even after the Great Depression, the Dot Com bubble and the Financial Crisis 2008. If you would have left this $10 as cash in 1914, this would have shrunk to 36 cents due to inflation today.

The course is designed in an amicable theme along with animated videos that can help the audience learn with ease. The Course looks into more than 40 Ratios and 6 Intrinsic Calculators to help an investor Value a stock.

Unlike other courses where comprehensive knowledge is provided about stock education. a study have been conducted on two separate sample stocks that can help an investor study a company in detail, learn the significance of annual reports and implement the ratios and intrinsic values.

The course is provided with more than 6 intrinsic value spreadsheets, various articles by the famous investors, annual reports of the sample companies and financial statements of the companies.

This course is also an amalgamation of the teachings of famous value investors of all time. The teachings of Benjamin Graham from The Intelligent Investor, One up on wall Street from Peter Lynch and principles of other investors like Philip Fisher and Warren Buffett have been included in the course.

Let's look at the Content

1. Our Sample Stock performed 78% in 6 months. (A glance into the course)

2. Introduction & Content of the Course

3. Financial Instruments of Investing

4. Benjamin Graham and Key Takeaways from The Intelligent Investor

5. How do Stock Markets Work?

6. Power of Compounding Interest

7. Are you better off without an Advisor?

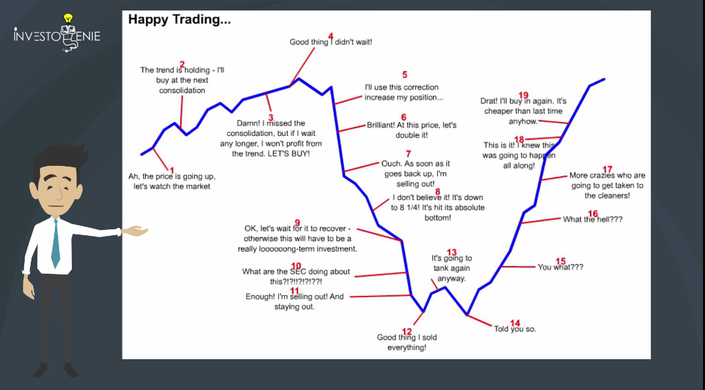

8. Day Trading VS Value Investing

9. Fundamental VS Technical Analysis

10. Different Companies and Approaches

11. Where to Look for Stocks?

12. Stock Screeners

13. How to read Annual Reports part 1

14. How to read Annual Reports part 2

15. Financial Statements

16. How to do Financial Analysis of a company?

17. Price to Earnings

18. Stock Market Valuation

19. How to do Valuation Analysis of a company?

20. How to do Business Analysis of a company?

21. How to do Management Analysis of a company?

22. More Ratios

23. Power of Free Cash Flows

24. Z, M & F Scores

25. Monitoring Stocks

26. When to Sell a stock?

27 - 32. 6 Different Intrinsic Value Calculators

33. Growth, Stability and Valuation Ratios

This is an awesome flagship course which means you get:

- Hours and hours of video based lessons.

- Lifetime access to the course so you get updates and new bonus lessons for FREE.

- Quizzes that will test and confirm your knowledge.

- Ability to participate in online discussions to share ideas with other students and get answers to your questions from the instructor who will answer every question.

- Ask questions directly of the instructor and every one of those will also be answered.

Disclaimer Note: This course is for educational and informational purposes only. There will be no recommending of any particular investments such as a particular stock or mutual fund. The Sample Stocks used in the course are for educational purpose only and we do not imply or give a buy or sell call on any of the stocks. The Instructor will have no liability related directly or indirectly to any loss or damage.

Also you don't want to miss the promotional video. Have a go!

So, what are you waiting for? Let's learn together. .

Prerequisites:

- This course is for anyone who is eager to learn investing from scratch

- There are no prerequisites but having a finance background is definitely an edge

Target Students:

- Course is perfect for 9 - 5 working employees who are seeking best strategies to invest in a stock market

- Excellent for people who are willing to Grow their investments in time

- This is course is NOT for investors who wants to know the MAGIC FORMULA for becoming rich overnight

- The course is on fundamental analysis. Any investor who is looking for Day Trading Strategy should consider looking at other courses

At the End of the course, students would be able to:

- Have complete understanding and confidence when investing in the Stock Market.

- Master the concepts of key financial instruments available for an investor

- Shortlist different investing approaches and select an approach for our stock investing

- Lifetime access to Value Investing in Growing Companies course allows you to apply and learn the concepts anytime you want

- Use Basic & Advanced Stock Screeners so you can narrow the choices to the best stocks for you

- Apply more than 40 Ratios and 6 Intrinsic Value Calculators to check the value of the stock

- Lifetime access to 6 Intrinsic Value Calculators, annual reports of the companies and few articles to help you in stock hunting

Your Instructor

Ammar Yaseen has been a value investor for more than 5 years. His background in finance and keen interest in studying financial gurus and their strategies have led him to develop interesting investment courses. His life lessons led him to find a strategy that can be beneficial for 9-5 employees who have littile or no knowledge regarding stock investing.

Investogenie Experience: (The website is under maintenance for now. We will update you here as soon as it is ready). The concept of Investogenie evolves around three key questions. Why, How and What

Why we do it: We believe in making a life of an investor much easier and comfortable by challenging the outdated models of looking at stocks.

How we do it: We have used simple rules and principles laid by top famous investors and implement them in a precise easy way.

What we do: Giving you the best unique features to look at your stocks according to your requirements and criteria Give it a Try?